Max Your 401(k) The Right Way

For your 401(k) there is a maximum amount you can contribute each year. In 2020 you can contribute $19,500. If you are over the age of 50, there is a catch-up contribution of $6,500. While the thought of reaching the maximum contribution level may seem daunting, it is not if you increase your contribution amount each year. We nudge our clients to increase their contribution to achieve this goal. For some people, the maximum 401(k) contribution is enough to meet their retirement goals. Others will need to invest outside of their workplace retirement plan to reach their financial goals.

Maxing out your 401(k) is great, but you want to make sure you also receive the entire match from your employer. Depending on how your company’s 401(k) plan is set up you could be leaving money on the table. Missing out on some of the employer match is an issue we regularly see with our clients who have commission or incentive based compensation packages. Their income is less consistent and harder to predict from year to year or quarter to quarter. If you are contributing more than the employer’s match on a percentage basis, you aren’t necessarily receiving all of the match dollars available to you.

When looking at your 401(k) plan you will want to understand is the match offered on a per pay period basis or plan year. If your plan uses a pay period match, it means if you contribute during a pay period you will receive a match. However, if you reach the max contribution level before your last paycheck, you would be missing out on your employer’s match. If your employer offers a match based on a plan year, then you will still receive the match even if you hit the max contribution early in the plan year. We encounter plan year matches less often. You can reach out to your HR representative or review your plan’s Adoption Agreement to find out what type of match your 401(k) plan offers. Additionally, if your plan as a "True Up" feature then at the end of the year you will be able to receive a full match from any missed matches during the year.

Let’s walk through a few examples of 401(k)s with pay period employer matches.

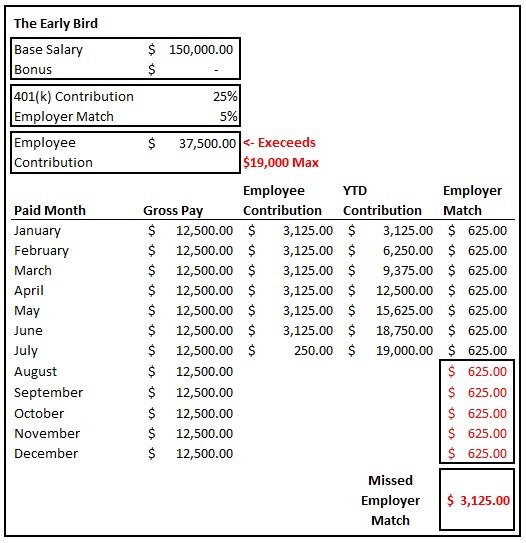

The Early Bird:

Some of our clients like to reach the max early in the year. Their thought process is if they reach the max sooner then they don’t have to worry about it throughout the year. They also believe this gives them a greater ability to compound their money faster. In this example, we have someone who earns $150,000 per year and receives no bonus. They are contributing 25% to their 401(k) to reach the max as soon as possible. Their company matches 5% on their salary on a per paycheck basis. They get paid monthly.

The current contribution rate does not work great for the Early Bird. They are missing out on $3,125 of employer contributions because they reach the $19,500 max contribution in July. There are five months where they are not getting their employer’s match. The fix for this is straightforward. By adjusting their contribution rate to 12.75%, they will reach the max contribution rate in December and recapture their missing employer match. Since this person does not have any bonus or other variable income the adjustment is easy. They’ll be able to reach the max with an easy calculation each year.

A Big Bonus

Our second example is looking at someone with variable compensation. This type of situation is where we see most people who contribute to a 401(k) fail to receive all their employer matching dollars. In this example, the person has a base of $190,000 and receives a $125,000 bonus in September. Their bonus is volatile ranging from $25,000 to $200,000 depending on their business unit’s production. They have set their contribution rate to 15% because early in their career they wanted to contribute 15% of their income to retirement. The company matches 5%, they are paid monthly, and their plan is based on a per paycheck basis.

It can be difficult to predict how much you might earn in a given year because of commissions, bonuses or other incentive based compensation. In this example, you can see it leads to missing out on over $9,400. If you earn variable compensation throughout the year, you will want to work with your financial planner to adjust your contribution rates to ensure you are not leaving cash on the table. In this case, reducing the contribution rate to 6% will both max their contribution and give them the full employer match.

Some plans allow for aftertax 401(k) contributions. This plan feature gives you the option to contribute additional money once you hit your max contribution of $19,500. You will continue to receive the match as long as you contribute, either on a pre or after tax basis. An after tax 401(k) contribution is not a tax deductible contribution and is different from a Roth 401(k) contribution. You can roll an after tax 401(k) contribution into a Roth IRA.

The goal of contributing the max to your 401(k) is a financial achievement, but you want to make sure you are doing it in the best way possible.

Please contact us at 913-871-7980 or by email to discuss your financial planning and investment management needs.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.