US Market Viewpoints Q4 2021

Stocks finished the quarter and year on a strong note despite concerns surrounding new strains of COVID 19 and high inflation data. The S&P 500 wrapped up 2021 just below all-time highs but saw 70 record highs reached this year. This is the second most ever record highs seen, only topped by 1995. Robust corporate earnings and economic growth were the catalysts to lift stocks this year. Inflation continues to be something to monitor. It peaked this fall at 6.8%, which was its highest level since 1982. To address higher than anticipated inflation, the Federal Reserve (Fed) has signaled they plan to scale back their asset purchases and possibly raise interest rates sooner in 2022.

The great returns from the market only tell part of the story. The market was led by a handful of stocks that drove most of the returns. Apple, Microsoft, and Alphabet (Google) are the three largest companies by market cap and all outperformed this year. Apple rose 34.77%, Microsoft jumped 52.7%, and Alphabet surged 66.22%. These three stocks have done a lot of the heavy lifting, accounting for about 1/3 of the S&P 500's returns. All three companies achieved their highest levels of profits ever. While some companies have surged over the past 12 months, there has been a correction with some of the 2020 pandemic darlings like Zoom (58.6% off from highs) and Peloton (78.6% decline from highs). Unprofitable growth stocks also saw a significant correction. There are over 300 companies that are not producing a profit which have seen their shares fall by more than 50% from recent highs. This is a positive sign that investors are shifting their attention to profitable companies with more reasonable valuations.

2021 saw all sectors post positive results with energy, real estate and technology leading the way. Energy rebounded after a dismal 2020 to gain 46.44% for the year. A rebound in consumer travel and a surge in crude prices saw energy's best annual performance since 1990. The real estate sector benefited from the rise in inflation and added 41.71%. Tech continues to do well, adding 35.17%. Apple and Microsoft are large components of this sector and both had terrific years. The lowest-performing sectors were utilities (+12.7%) and consumer staples (+13.4%).

Investment Strategy

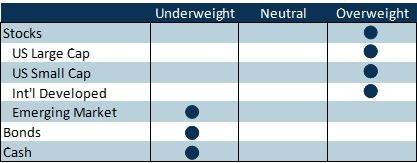

There is a slight change to our investment strategy after our December Investment Committee Meeting. We have shifted our position on Emerging Market stocks from Neutral to Underweight. This has a small impact on your portfolio because Emerging Markets represent our lowest percentage of holdings. We made this change because of concerns over Chinese growth in 2022 and the opportunities in developed markets are more attractive. Our stance to remain underweight bonds is unchanged, given expectations that interest rates will increase in 2022 is unchanged.

Outlook

We remain optimistic that stock performance will continue to be positive next year. The market has additional obstacles to digest. The Federal Reserve will start to address inflation. We anticipate economic growth rates will start to moderate, and investors will start predicting how the mid-term elections might impact different areas of the market. We expect these issues to lead to additional volatility and uncertainty, especially if COVID persists in 2022.

Inflation and the Federal Reserve's moves are linked in our view. There will continue to be some inflation on products due to supply chain disruptions but expect an improvement steadily through the year. Wage inflation is likely to be stickier. Generally, once people earn more, they don't see pay cuts or switch jobs to make less money; hence, wage inflation will likely stay with us for longer. We do not expect the near 7% inflation to hang around, but inflation between 2.5% and 3% should be expected in 2022.

When the Fed starts to raise interest rates, there are some fears that it may suggest the end of a bull market in stocks and the economy will dramatically slow. There is not much evidence that stocks will pull back substantially once the Fed increases rates based on history. Three and six months before rate increases, stocks have a strong performance. Once the first-rate increase happens, there continues to be positive momentum for stocks for the next quarter or two. The one thing we'll be watching for is how quickly the Fed acts to raise rates. If they take a steady approach, this bodes well for performance. Seeing the Fed raise rates in consecutive meetings is usually an environment when stocks don't perform as well.

Mid-term elections are on the docket for 2022 (yeah, the return of robocalls!) We tend to overemphasize how politics impact our portfolio; however, mid-term election years have some trends worth reviewing. First off, mid-term years historically produce above-average rates of return for the entire year. The downside is the summer months generally have more volatility and lower returns than average. This makes sense because in the lead-up to an election, people are uncertain about the outcome which may have investors sitting on the sidelines or taking a defensive posture. This does contribute to our thinking that this will be a positive but more volatile year.

Given the issues discussed above, why are we optimistic about stock market performance in 2022? We think that corporate profits and consumers are in great shape for the year ahead and beyond. Companies are expected to see earnings growth over the next three years. This outlook is positive for companies to maintain their record level of stock buybacks, which supports the market. Individuals are in terrific financial shape. Household net worth is at its highest levels on record and savings rates continue to be above historical averages while the percentage of income needed to service debt is at its lowest level since this has been traced back to 1980. This coupled with a great job market helps shape our outlook.

Expect a positive year, but we anticipated that there will be additional volatility, which means there could be periods of negative performance. This is normal in any market year, but we want to temper expectations after three consecutive years of double-digit annual gains. We encourage you to revisit our US Market Viewpoints from Q2 2021 which discusses this in more detail.

Andrew Comstock, CFA

Principal - Wealth Advisor